“The Algebra of Wealth: A Simple Formula for Financial Security” presents a data-driven approach to building wealth in the modern economy. Scott Galloway, a professor at NYU Stern and successful entrepreneur, combines academic research with practical experience to create an actionable framework for financial success.

The book’s unique perspective bridges the gap between theoretical finance and real-world wealth building. Published in an era of increasing wealth inequality and economic uncertainty, this book arrives at a crucial time when traditional financial advice often falls short of addressing modern economic challenges.

Core Concepts

Galloway introduces the “wealth equation,” breaking down wealth creation into four key variables:

- Focus: Identifying and pursuing high-value opportunities

- Stoicism: Maintaining emotional discipline in financial decisions

- Time: Leveraging compound growth through patient investing

- Diversification: Building resilience through strategic asset allocation

These principles form the foundation of what Galloway calls “the algebra of wealth” – a systematic approach to financial success.

Chapter-by-Chapter Review

The Focus Formula

Galloway begins by dismantling the myth of multitasking in wealth building, demonstrating how concentrated effort in key areas yields superior results. The chapter provides actionable frameworks for identifying high-value opportunities in your career and investments. Of particular value is his “Focus Matrix,” which helps readers evaluate opportunities based on potential return and required effort. The chapter includes practical exercises for developing industry expertise and positioning yourself in growing sectors.

The Stoic Investor

This pivotal chapter addresses the psychological challenges of wealth building, introducing the concept of “emotional alpha” – the additional returns generated by maintaining composure during market volatility. Galloway provides specific techniques for developing investing resilience, including his “72-hour rule” for major financial decisions. The chapter features real-world examples of how emotional discipline has separated successful investors from the pack, particularly during major market downturns.

Time as Your Greatest Asset

Perhaps the book’s most compelling chapter, it quantifies the exact cost of delayed investment through detailed case studies and compelling visualizations. Galloway introduces the “Wealth Multiplication Timeline,” showing how different investment strategies compound over various timeframes. The chapter includes specific strategies for accelerating your timeline to financial independence, including a framework for evaluating which expenses to cut and which to maintain for long-term wealth building.

The Art of Diversification

Building on modern portfolio theory, this chapter provides practical guidance for creating a resilient investment strategy. Galloway goes beyond basic asset allocation to explore geographic diversification, skill development, and income stream multiplication. The chapter includes detailed portfolio models for different risk tolerances and life stages, with specific advice for rebalancing and adjusting your strategy as market conditions change. Particularly valuable is his “Diversification Defense” framework for protecting wealth during economic downturns.

Key Strengths

- Data-driven insights backed by academic research

- Practical implementation strategies for different income levels

- Clear explanations of complex financial concepts

- Engaging storytelling that makes finance accessible

Potential Drawbacks

- Some strategies may be challenging for lower-income readers

- US-centric perspective on markets and investment options

Who This Book Is For

“The Algebra of Wealth” is of value for:

- Young professionals starting their wealth-building journey

- Mid-career individuals looking to optimize their financial strategy

- Anyone interested in understanding the systematic approach to wealth creation

- Entrepreneurs seeking to build sustainable wealth

Final Review

“The Algebra of Wealth” delivers a compelling framework for financial success, combining academic rigor with practical application. The book’s systematic approach to wealth building makes complex financial concepts accessible and actionable.

Rating: 4.6/5

A must-read for anyone seeking a structured approach to building lasting wealth. The book’s greatest achievement lies in its ability to transform complex financial concepts into a clear, actionable framework that readers can apply regardless of their starting point.

Alternative Books

If you are looking for other books like “The Algebra of Wealth” , consider these alternatives:

“The Psychology of Money” by Morgan Housel

Explores the behavioral aspects of wealth building

Rating: 4.7/5

“The Simple Path to Wealth” by JL Collins

Offers a streamlined approach to investing and financial independence

Rating: 4.7/5

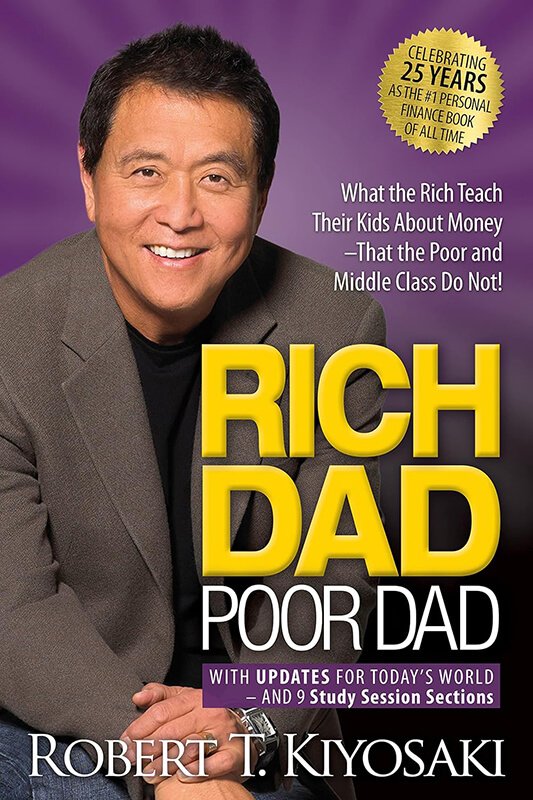

“Rich Dad Poor Dad” by Robert T. Kiyosaki

Provides fundamental mindset shifts for wealth creation

Rating: 4.5/5