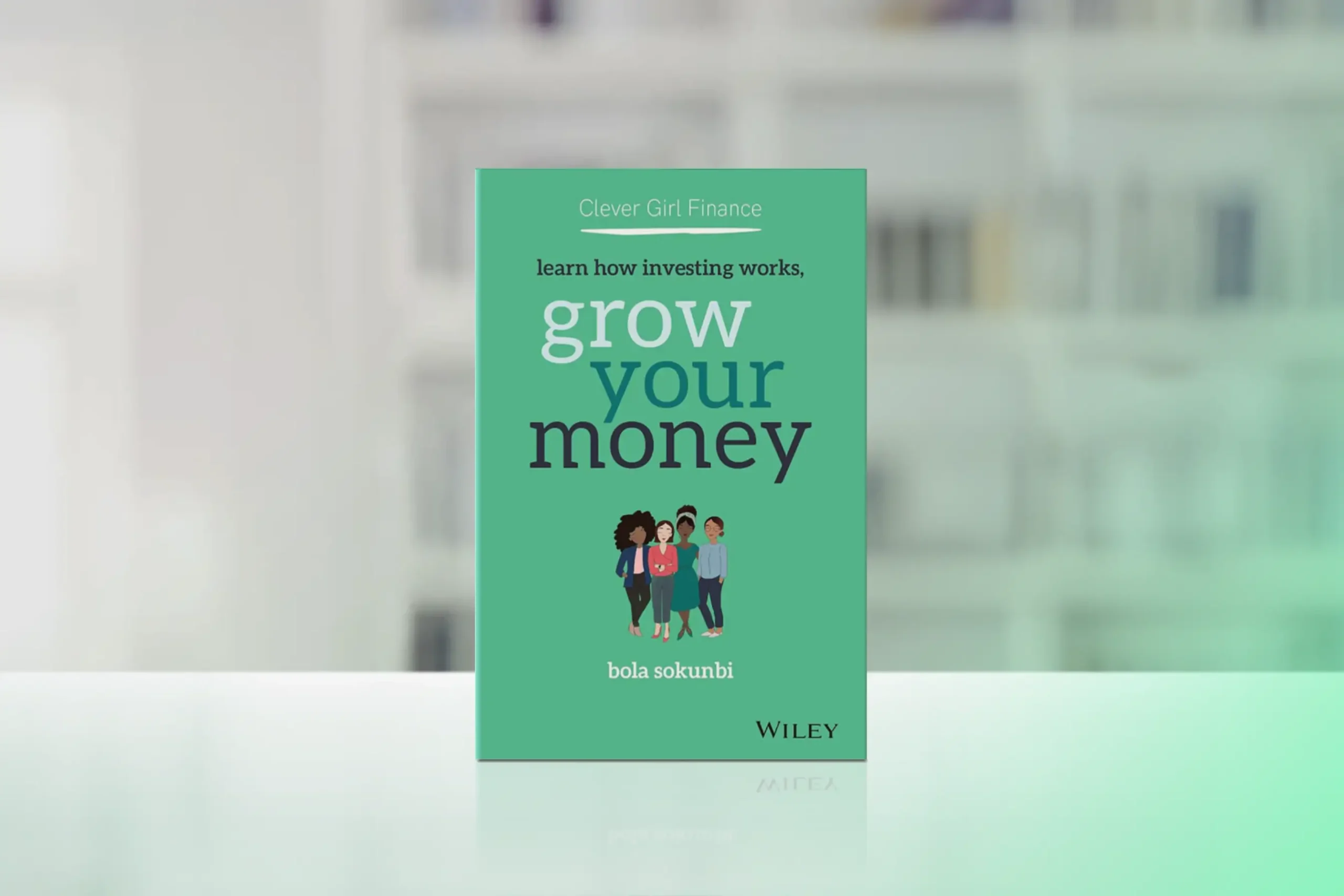

In today’s complex financial landscape, finding clear, actionable guidance for building wealth can be challenging. Bola Sokunbi’s “Clever Girl Finance: Learn How Investing Works, Grow Your Money” offers a refreshing and empowering approach to financial literacy, particularly resonating with women seeking to take control of their financial future.

The book stands out for its ability to combine practical financial advice with powerful mindset strategies that address the unique challenges and opportunities women face in building wealth.

Core Concepts

Sokunbi builds her financial framework around three fundamental pillars:

- Building a solid financial foundation through mindset and habits

- Creating and executing a personalized money management system

- Growing wealth through strategic saving, investing, and debt elimination

The book emphasizes the importance of financial education as a tool for empowerment, showing readers how to break free from limiting beliefs about money while providing practical strategies for building lasting wealth.

Chapter-by-Chapter Review

Foundation First

Sokunbi begins by addressing money mindset and financial habits, helping readers understand their relationship with money. She explores common money beliefs and provides practical worksheets for assessing current financial situations and setting achievable goals.

Budgeting and Saving

The book introduces Sokunbi’s “50-30-20” budgeting method, offering templates for different income levels and life situations. She provides actionable strategies for building emergency funds and maximizing savings without compromising lifestyle quality.

Debt Management

This section presents both avalanche and snowball methods of debt repayment, helping readers choose the most suitable approach. Sokunbi addresses both practical and emotional aspects of debt elimination, emphasizing sustainable strategies for long-term success.

Investing for the Future

Sokunbi demystifies investing by breaking down complex concepts into manageable steps. The chapter covers essential investment vehicles, from retirement accounts to index funds, while addressing common fears and misconceptions that often prevent women from investing.

Career and Side Hustles

The final chapters focus on increasing income through career advancement and side hustles. Sokunbi provides concrete strategies for salary negotiation and identifying profitable income opportunities, supported by real-world case studies.

Key Strengths

- Highly practical approach with actionable steps

- Clear, jargon-free explanations of complex financial concepts

- Strong emphasis on building sustainable financial habits

- Relatable examples and case studies

- Comprehensive resources and worksheets

Potential Drawbacks

- Some concepts may feel basic for advanced investors

- US-centric financial advice and examples

- Limited coverage of advanced investing strategies

Who This Book Is For

This book is particularly valuable for:

- Women beginning their financial journey

- Young professionals seeking to build wealth

- Anyone looking to develop better money management habits

- Individuals working to eliminate debt while building savings

Final Review

“Clever Girl Finance” excels at making financial literacy accessible and actionable. It provides a comprehensive roadmap for financial success while maintaining an engaging and encouraging tone throughout. The book’s practical approach and clear guidance make it an excellent resource for anyone looking to build a strong financial foundation. What sets this book apart is its unique ability to address both the practical and emotional aspects of money management, making it a standout choice for readers seeking a holistic approach to financial wellness.

Rating: 4.6/5

This book stands out for its ability to transform complex financial concepts into achievable action steps.

Alternative Books

Here are three excellent alternatives to “Clever Girl Finance”:

“The Psychology of Money” by Morgan Housel

A thought-provoking exploration of how emotions and behavior influence financial decisions.

Rating: 4.7/5

“The Simple Path to Wealth” by JL Collins

A straightforward guide to building wealth through long-term investing strategies.

Rating: 4.6/5

“I Will Teach You to Be Rich” by Ramit Sethi

A comprehensive approach to personal finance with a focus on automation and psychology.

Rating: 4.5/5