In the realm of personal finance literature, Bill Perkins‘ “Die With Zero” stands out as a provocative and refreshing perspective on how to approach money and life. Published in 2020, this thought-provoking book challenges conventional wisdom about saving and retirement, arguing instead for a more balanced approach that prioritizes life experiences over wealth accumulation. Perkins, a successful energy trader and hedge fund manager, presents a compelling case for optimizing your life’s ‘return on investment’ by spending your money and time more strategically throughout your lifetime.

Core Concepts

Perkins introduces several key concepts that form the foundation of his Die With Zero philosophy:

- Time Value of Life Experiences: Recognizing that experiences are more valuable when you’re younger and healthier.

- Memory Dividends: Understanding that experiences create lasting memories that pay dividends over time.

- Personal Net Worth Curve: Optimizing your wealth curve to peak at the right time, not at the end of your life.

- Effective Giving: Transferring wealth to the next generation earlier when it can have more impact.

- Life Optimization: Balancing earning, saving, and spending to maximize life satisfaction.

- Health Bucket: Considering health as a crucial factor in life planning and experience optimization.

These concepts aim to shift your perspective on money management, encouraging you to view wealth as a tool for creating meaningful experiences rather than an end goal. By applying these principles, you’ll be better equipped to make intentional decisions about how to allocate your time and resources throughout your life.

Chapter-by-Chapter Review

Chapter 1: Dying With Zero

Perkins introduces his radical premise and explains why dying with zero (or close to it) is a worthy goal.

Chapter 2: Maximize Your Positive Life Experiences

This chapter explores the concept of life optimization and why experiences should be prioritized over wealth accumulation.

Chapter 3: Why You Need to Die With Zero

Perkins delves deeper into the rationale behind his philosophy, addressing common objections and misconceptions.

Chapter 4: Spend Out Your Money – But Not Too Fast

This chapter provides strategies for balancing spending on experiences while ensuring financial security.

Chapter 5: Invest in Experiences Early

Perkins argues for front-loading life experiences when you’re young and can enjoy them most fully.

Chapter 6: Live an Optimal Life

This chapter introduces tools and frameworks for optimizing your personal spending and saving decisions.

Chapter 7: Take Risks… With Everything

Perkins encourages calculated risk-taking in various aspects of life to maximize potential rewards.

Chapter 8: Give With Warm Hands

The final chapter discusses the benefits of giving to others earlier in life rather than leaving a large inheritance.

Key Strengths

- Challenges conventional wisdom about saving and retirement in a thought-provoking way

- Provides a fresh perspective on the relationship between money and life satisfaction

- Offers practical frameworks for making financial decisions aligned with life goals

- Encourages readers to be more intentional about how they spend their time and money

- Balances financial advice with a strong emphasis on personal fulfillment and experiences

Potential Drawbacks

- The “die with zero” concept may be too extreme for some readers’ comfort levels

- Limited discussion of potential financial setbacks or unexpected life events

- May not fully address the needs of those with limited financial resources

Who This Book Is For

Die With Zero is an invaluable resource for a wide range of readers, including:

- Young professionals starting to think about long-term financial planning

- Mid-career individuals reassessing their work-life balance and financial goals

- Those approaching retirement and considering how to best use their accumulated wealth

- Anyone feeling trapped by traditional notions of saving and looking for a more fulfilling approach to money management

Final Review

Die With Zero offers a refreshing and provocative perspective on personal finance that challenges readers to rethink their relationship with money and time. Perkins presents a compelling argument for prioritizing experiences and personal fulfillment over mere wealth accumulation, backed by logical reasoning and practical strategies.

While the concept of dying with zero may seem radical at first, Perkins’ nuanced approach balances this goal with the need for financial security. The book’s greatest strength lies in its ability to shift your mindset about money, encouraging a more intentional and experience-focused approach to life planning.

By embracing the principles outlined in Die With Zero, you can develop a more balanced and fulfilling approach to managing your resources. Whether you’re just starting your financial journey or reevaluating your long-term plans, this book provides valuable insights that can help you maximize your life’s “return on investment” and create lasting, meaningful experiences.

Rating: 4.4/5

An eye-opening and thought-provoking guide that challenges conventional financial wisdom and empowers readers to live richer, more fulfilling lives by optimizing their use of time and money.

Alternative Books

If you found Die With Zero intriguing and want to explore similar themes in personal finance and life optimization, consider these related books from our curated list:

Your Money or Your Life by Vicki Robin and Joe Dominguez

Offers a holistic approach to money management that aligns with Perkins’ emphasis on using financial resources to create a fulfilling life.

Rating: 4.5/5

The Total Money Makeover by Dave Ramsey

While more traditional in its approach to personal finance, this book provides solid foundational principles that can complement the Die With Zero philosophy.

Rating: 4.7/5

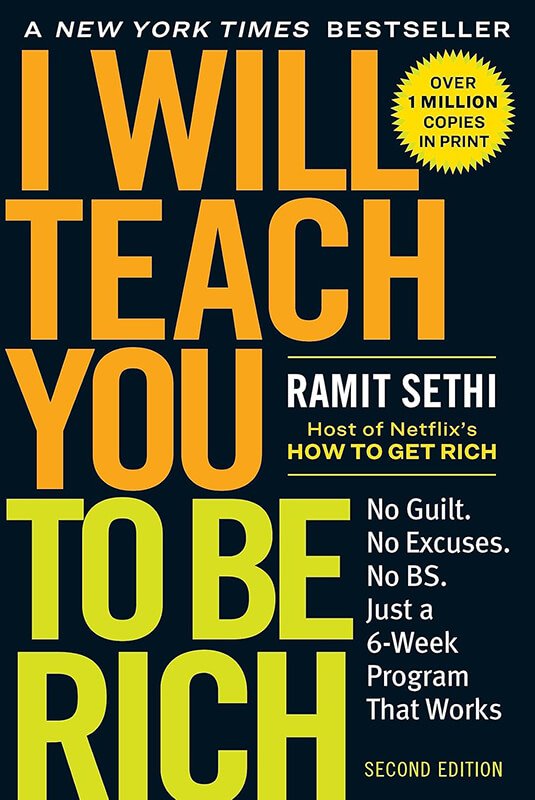

I Will Teach You to Be Rich by Ramit Sethi

Presents a modern take on personal finance that, like Perkins’ book, emphasizes spending on what truly matters to you while building long-term wealth.

Rating: 4.5/5