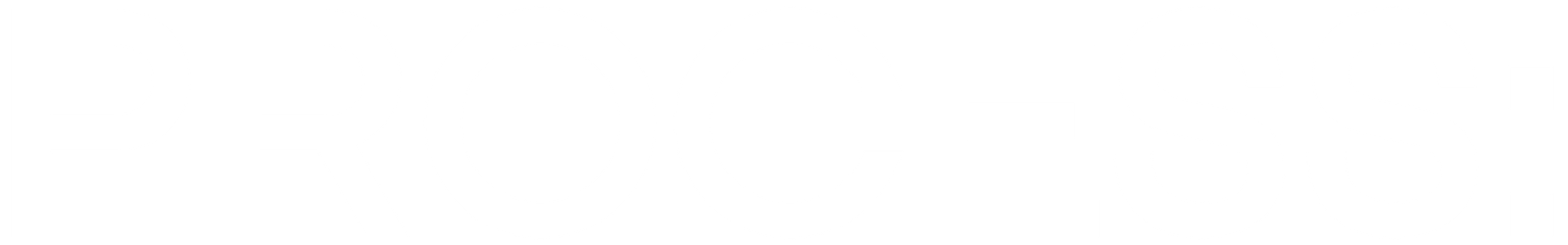

“Rich AF: The Winning Money Mindset That Will Change Your Life” offers a modern, no-nonsense approach to financial literacy, particularly resonating with younger generations seeking practical money management strategies.

Published in 2023, Vivian Tu leverages her Wall Street background and social media influence to demystify personal finance concepts. The book stands out for its ability to translate complex financial principles into digestible, actionable steps for today’s digital-native audience.

Core Concepts

The book centers on transforming your relationship with money through:

- Understanding financial fundamentals without the jargon, focusing on building a strong foundation of money management principles that work in today’s economy

- Building wealth through strategic investing and debt management, with emphasis on modern investment vehicles and debt reduction strategies

- Creating sustainable money habits for long-term success, including automated savings and investment approaches

- Navigating modern financial challenges and opportunities, from cryptocurrency to side hustles

- Developing a growth mindset around money and wealth creation while maintaining work-life balance

Chapter-by-Chapter Review

Foundation Building

Explains essential financial concepts through relatable examples and clear actionable steps. Tu breaks down complex topics like credit scores, emergency funds, and budgeting basics. The chapter includes practical exercises to assess your current financial situation and set realistic goals. Her approach to budgeting introduces the “money bucket” system, making expense tracking more intuitive for beginners.

Debt Management

Provides strategic approaches to tackle different types of debt, from student loans to credit cards, with practical prioritization methods. Tu introduces the “debt snowball vs. avalanche” debate with a fresh perspective, helping readers choose the most suitable approach for their situation. The chapter includes real-world case studies of successful debt elimination strategies and common pitfalls to avoid.

Investment Fundamentals

Demystifies investing for beginners, covering stock markets, retirement accounts, and cryptocurrency with contemporary insights. Tu explains modern investment platforms and apps, making investing accessible to tech-savvy readers. The section on retirement planning is particularly strong, offering clear guidance on 401(k)s, IRAs, and employer matching optimization.

Building Wealth

Explores multiple income streams, salary negotiation, and long-term wealth building strategies through real estate and other investments. The chapter includes detailed scripts for salary negotiations and tips for identifying profitable side hustles. Tu’s insights on real estate investing, from REITs to direct property ownership, provide a comprehensive overview of property-based wealth building.

Financial Independence

Outlines practical steps toward achieving financial freedom while maintaining a balanced lifestyle. The chapter includes detailed benchmarks for different stages of financial independence and strategies for maintaining motivation during the wealth-building journey. Tu addresses common obstacles and provides solutions for staying on track.

Key Strengths

- Fresh, modern perspective on traditional financial concepts

- Clear, actionable advice without overwhelming technical details

- Relevant examples for millennials and Gen Z

- Practical strategies for both immediate and long-term financial growth

- Engaging writing style that maintains reader interest

Potential Drawbacks

- Some concepts may be too basic for experienced investors

- U.S.-centric financial advice

- Limited coverage of advanced investment strategies

Who This Book Is For

- Young professionals starting their financial journey

- Career-focused individuals seeking financial independence

- Anyone looking to understand modern investing and wealth building

- Social media-savvy readers wanting practical money advice

Final Review

“Rich AF” successfully bridges the gap between traditional financial advice and modern money management needs. Its straightforward approach and practical strategies make it an excellent resource for building financial confidence and literacy. The book’s greatest strength lies in its ability to make complex financial concepts accessible while providing actionable steps for implementation, making it a valuable addition to any young professional’s library. The book excels at providing a framework for financial success that resonates with modern readers while maintaining practical applicability.

Rating: 4.6/5

A comprehensive guide that makes financial literacy accessible and actionable for today’s generation.

Alternative Books

Here are three related books that complement “Rich AF”:

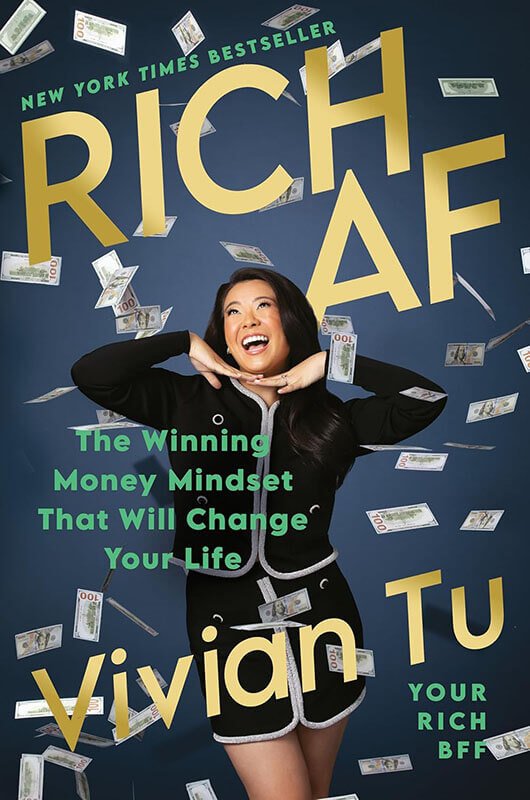

“The Psychology of Money” by Morgan Housel

A deeper dive into the behavioral aspects of financial decision-making

Rating: 4.7/5

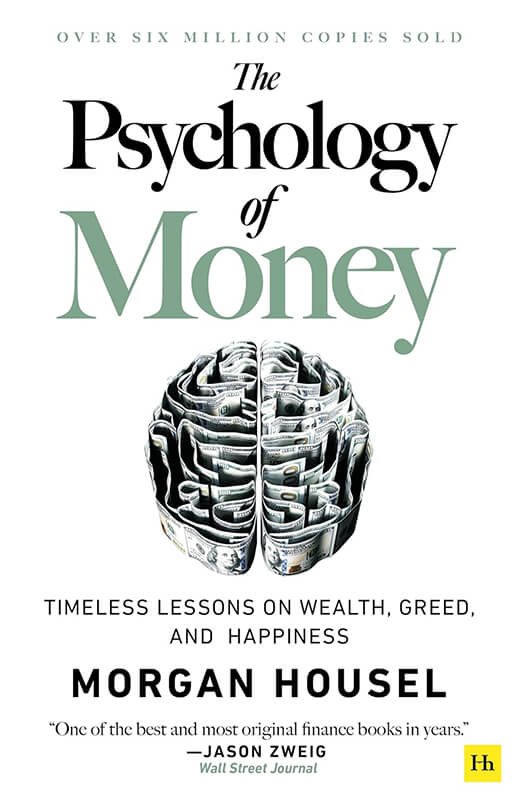

“I Will Teach You to Be Rich” by Ramit Sethi

Another modern approach to personal finance with detailed systems and strategies

Rating: 4.5/5

“Clever Girl Finance” by Bola Sokunbi

Focuses on empowering financial advice with practical implementation steps

Rating: 4.7/5