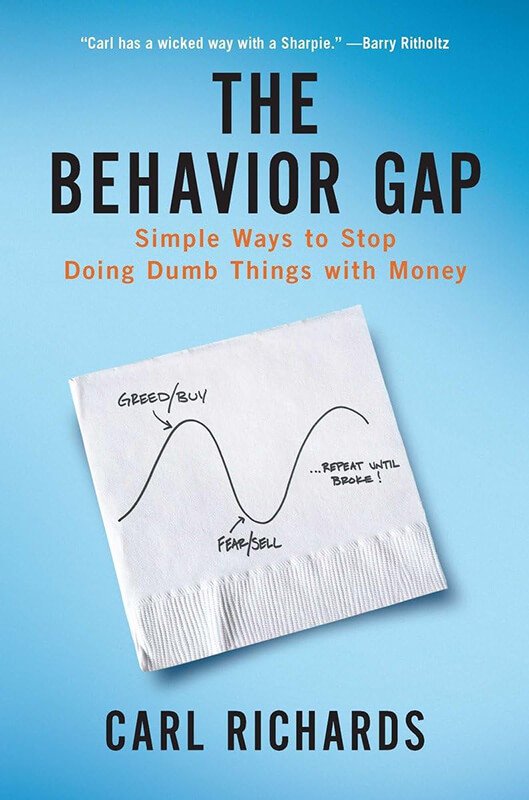

Carl Richards‘ “The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money,” published in 2012, is a refreshing and insightful exploration of the psychological factors that influence our financial decisions. Drawing from his experience as a financial planner and his talent for simplifying complex ideas through sketches, Richards offers a unique perspective on why we often act irrationally with money. This book shines a light on the gap between what we know we should do financially and what we actually do, providing practical strategies to overcome our behavioral biases and make smarter financial choices.

Core Concepts

“The Behavior Gap” presents several key ideas that form the foundation of Richards’ approach to personal finance:

- The behavior gap: The difference between investment returns and investor returns due to poor decision-making

- Emotional decision-making: How our feelings often override logic in financial matters

- The importance of self-awareness in financial planning

- Simplicity as a powerful tool in managing money

- The value of focusing on what you can control in your financial life

These concepts empower readers to recognize their own behavioral patterns and develop strategies to make more rational, beneficial financial decisions.

Chapter-by-Chapter Review

Chapter 1: The Behavior Gap Explained

Richards introduces the concept of the behavior gap, illustrating how emotional decision-making can lead to poor investment choices and suboptimal financial outcomes.

Chapter 2: We Fall in Love

This chapter explores how we often become emotionally attached to investments, leading to irrational holding patterns and missed opportunities.

Chapter 3: We Search for Meaningless Patterns

Richards discusses our tendency to see patterns where none exist, particularly in market movements, and how this can lead to misguided investment strategies.

Chapter 4: We Tell Ourselves Stories

Here, the author delves into the narratives we create to justify our financial decisions, often at the expense of objective analysis.

Chapter 5: We Fear the Wrong Things

This section addresses how misplaced fears can lead to counterproductive financial behaviors, such as avoiding necessary risks or overreacting to market volatility.

Chapter 6: We Make Decisions Based on Incomplete Information

Richards highlights the dangers of making financial decisions without a full understanding of the context or long-term implications.

Chapter 7-12: Strategies for Improvement

The remaining chapters offer practical advice for overcoming behavioral biases, including focusing on personal goals, embracing simplicity, and developing a long-term perspective on financial planning.

Key Strengths

- Accessible and engaging writing style with simple, effective illustrations

- Practical, actionable advice for improving financial decision-making

- Emphasizes self-awareness and emotional intelligence in financial matters

- Offers a fresh perspective on personal finance beyond traditional advice

- Encourages readers to focus on what truly matters in their financial lives

Potential Drawbacks

- Some readers may desire more in-depth technical financial advice

- The simplicity of the approach may feel insufficient for complex financial situations

- Certain concepts may be familiar to those well-versed in behavioral economics

Who This Book Is For

“The Behavior Gap” is an invaluable resource for a wide range of readers, particularly:

- Individual investors looking to improve their decision-making process

- Anyone struggling with emotional reactions to money and investing

- Financial professionals seeking to better understand and serve their clients

- Those interested in the psychology of financial behavior

Final Review

“The Behavior Gap” offers a refreshing and accessible approach to understanding the psychological aspects of personal finance. Carl Richards’ unique blend of simple sketches and insightful commentary makes complex financial concepts approachable and actionable for readers at all levels of financial literacy.

The book’s greatest strength lies in its ability to help readers recognize and overcome their own behavioral biases. By focusing on the emotional and psychological factors that influence financial decisions, Richards provides a framework for more rational and effective money management.

While some readers may crave more technical financial advice, the emphasis on self-awareness and simplicity offers a valuable counterpoint to the often overwhelming world of personal finance. The practical strategies presented can lead to significant improvements in financial decision-making when consistently applied.

Rating: 4.5/5

An enlightening and practical guide that empowers readers to bridge the gap between financial knowledge and behavior, leading to smarter, more confident money decisions.

Alternative Books

If you are looking for other books like “The Behavior Gap”, consider these alternatives:

Thinking, Fast and Slow by Daniel Kahneman

Explores the cognitive biases that influence our decision-making processes.

Rating: 4.6/5

Your Money or Your Life by Vicki Robin and Joe Dominguez

Offers a holistic approach to managing money and aligning financial decisions with personal values.

Rating: 4.5/5

The Little Book of Common Sense Investing by John C. Bogle

Provides a straightforward approach to successful investing based on index funds.

Rating: 4.7/5