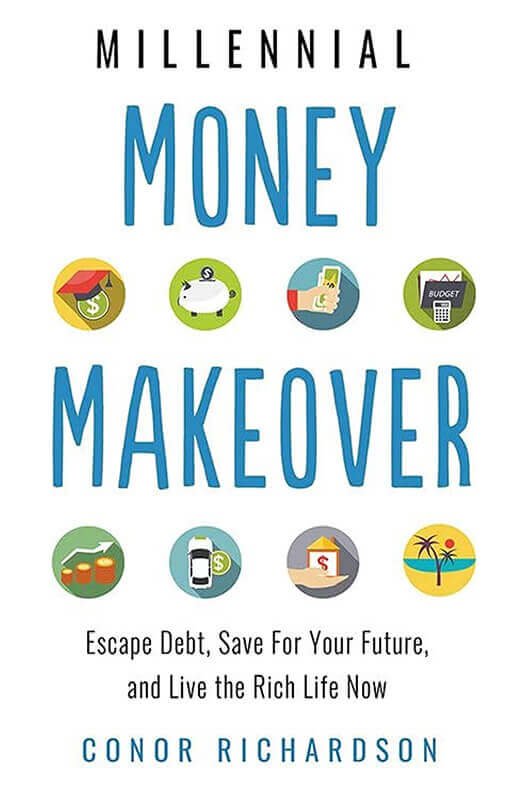

In a world where financial advice often feels outdated or out of touch, Conor Richardson’s “Millennial Money Makeover” emerges as a breath of fresh air. Published in 2019, this engaging guide speaks directly to the unique financial challenges and aspirations of the millennial generation. Richardson, a certified public accountant and financial literacy advocate, combines his professional expertise with a deep understanding of millennial life experiences to create a roadmap for financial success that resonates with today’s young adults. Whether you’re drowning in student debt, navigating the gig economy, or simply trying to make sense of your finances, this book offers practical, actionable advice to help you take control of your financial future.

Core Concepts

Richardson’s approach to millennial finance revolves around several key ideas:

- The importance of mindset in achieving financial success

- Practical strategies for tackling student loan debt

- Building a solid financial foundation through budgeting and saving

- Investing for the future, even with limited resources

- Balancing financial goals with lifestyle desires

- Leveraging technology and modern financial tools

Through these concepts, Richardson empowers millennials to take charge of their finances and build a secure future, regardless of their starting point.

Chapter-by-Chapter Review

Chapter 1: Millennial Money Mindset

Richardson kicks off by addressing the unique financial challenges facing millennials and introduces the concept of the “Millennial Money Mindset.” He emphasizes the importance of adopting a proactive and positive attitude towards money management.

Chapter 2: Destroy Debt

This chapter tackles one of the biggest financial hurdles for millennials: debt. Richardson provides practical strategies for paying off student loans and credit card debt, including the popular debt snowball and avalanche methods.

Chapter 3: Secure Stable Housing

Here, Richardson explores the rent vs. buy debate, offering insights to help readers make informed decisions about housing based on their individual circumstances and long-term goals.

Chapter 4: Build a Budget

This chapter introduces Richardson’s “Saver System” for budgeting, a flexible approach that aligns with the variable income streams many millennials experience. He provides practical tips for tracking expenses and prioritizing savings.

Chapter 5: Boost Your Credit Score

Richardson demystifies credit scores and offers actionable advice for improving and maintaining a strong credit profile, emphasizing its importance in achieving long-term financial goals.

Chapter 6: Invest in Your Future

This chapter breaks down the basics of investing, making it accessible even for those with limited funds. Richardson covers retirement accounts, index funds, and the power of compound interest.

Chapter 7: Design Your Financial Plan

The book concludes with guidance on creating a comprehensive financial plan, helping readers set and achieve both short-term and long-term financial goals.

Key Strengths

- Tailored specifically to millennial financial concerns and experiences

- Offers practical, actionable advice that can be implemented immediately

- Balances technical financial information with relatable examples and language

- Emphasizes the importance of mindset and personal values in financial planning

- Provides a holistic view of personal finance, covering a wide range of topics

Potential Drawbacks

- Some advice may feel basic for those already well-versed in personal finance

- The focus on U.S. financial systems may limit relevance for international readers

- Rapidly changing financial landscapes may date some specific recommendations

Who This Book Is For

“Millennial Money Makeover” is an invaluable resource for:

- Recent college graduates navigating their first financial decisions

- Millennials struggling with student loan debt or credit card debt

- Young professionals looking to build a solid financial foundation

- Anyone seeking a fresh, modern approach to personal finance

Final Review

Conor Richardson’s “Millennial Money Makeover” stands out in the crowded field of personal finance books by offering advice that truly resonates with the millennial experience. By addressing the unique challenges and opportunities faced by this generation, Richardson provides a roadmap that feels both achievable and inspiring.

The book’s strength lies in its ability to make complex financial concepts accessible without oversimplifying. Richardson’s tone is empowering and non-judgmental, acknowledging the financial realities many millennials face while offering hope and practical solutions.

While some readers may find certain sections too basic or U.S.-centric, the overall framework and mindset Richardson presents are valuable for anyone looking to improve their financial health. The emphasis on aligning financial decisions with personal values and long-term goals is particularly refreshing.

Rating: 4.5/5

This book is an essential read for any millennial looking to take control of their finances and build a secure, fulfilling future.

Alternative Books

If you find the concepts in “Millennial Money Makeover” interesting, you might also enjoy these related books:

I Will Teach You to Be Rich by Ramit Sethi

A comprehensive guide to personal finance with a focus on automation and psychology.

Rating: 4.5/5

You Are a Badass at Making Money by Jen Sincero

A motivational approach to overcoming financial obstacles and building wealth.

Rating: 4.7/5

The Financial Diet by Chelsea Fagan and Lauren Ver Hage

A relatable and practical guide to managing money for young adults.

Rating: 4.4/5