In a world where financial advice often seems complex and overwhelming, David Bach’s “The Latte Factor” emerges as a refreshing and accessible guide to achieving financial freedom. Published in 2019, this book takes a unique approach by weaving financial wisdom into a relatable story.

Bach, a renowned financial expert, introduces the powerful concept that small, daily financial decisions can lead to significant long-term wealth. Through the journey of the protagonist, Zoey, readers discover how seemingly insignificant expenses—like a daily latte—can impact their financial future. “The Latte Factor” isn’t just about cutting out coffee; it’s about rethinking our relationship with money and taking control of our financial destiny.

Core Concepts

At the heart of “The Latte Factor” lies a set of simple yet powerful principles designed to transform your financial life. Bach presents these ideas through an engaging narrative, making complex financial concepts accessible to everyone.

- Pay Yourself First: Automatically save and invest a portion of your income before spending on anything else.

- Don’t Budget – Make It Automatic: Set up automatic transfers to savings and investment accounts to ensure consistent saving.

- Live Rich Now: Find a balance between enjoying life today and saving for tomorrow.

- The Latte Factor: Small, daily expenses add up over time and can significantly impact your wealth if invested instead.

- The Power of Compound Interest: Start saving early to harness the incredible growth potential of compound interest.

- Overcoming Limiting Beliefs: Challenge your assumptions about money and what’s possible in your financial life.

- The Three Secrets to Financial Freedom: A simple framework for achieving financial independence.

These principles aim to empower you to take control of your finances, regardless of your current income or financial situation.

Chapter-by-Chapter Review

Chapters 1-5: Introducing Zoey and The Latte Factor

Bach introduces us to Zoey, a young professional struggling with finances despite a good job. Through her interactions with Henry, a barista, and Mr. Brewster, a successful businessman, Zoey begins to learn about the impact of small, daily financial decisions.

Chapters 6-10: Discovering Financial Wisdom

As Zoey continues her journey, she learns about the power of paying yourself first, making saving automatic, and the incredible impact of compound interest over time. Bach skillfully weaves these lessons into the story, making them easy to understand and relate to.

Chapters 11-15: Overcoming Limiting Beliefs

Zoey confronts her limiting beliefs about money and begins to see new possibilities for her financial future. Bach emphasizes the importance of mindset in achieving financial freedom.

Chapters 16-20: Implementing The Latte Factor

The story culminates with Zoey putting her new knowledge into action. Bach provides practical steps for readers to implement these principles in their own lives, regardless of their current financial situation.

Epilogue and Action Guide

Bach concludes with an epilogue showing Zoey’s transformed financial life and provides an action guide for readers to apply The Latte Factor principles immediately.

Key Strengths

- Presents complex financial concepts in an easy-to-understand, story-based format

- Offers practical, actionable advice that can be implemented immediately

- Emphasizes the power of small changes and consistency in building wealth

- Addresses both the practical and psychological aspects of managing money

- Provides hope and empowerment, especially for those feeling overwhelmed by their finances

Potential Drawbacks

- Some readers may find the story format less direct than traditional financial advice books

- The simplicity of the advice may not fully address more complex financial situations

- The focus on small expenses may overshadow larger financial issues for some readers

Who This Book Is For

“The Latte Factor” is an excellent resource for a wide range of readers seeking to improve their financial lives. It’s particularly well-suited for:

- Young professionals just starting their financial journey

- Anyone feeling overwhelmed or intimidated by personal finance

- Individuals looking for a fresh, motivational approach to managing money

- People who want to start building wealth but don’t think they earn enough

Final Review

“The Latte Factor” offers a refreshing and accessible approach to personal finance that has the power to transform your relationship with money. Bach’s use of storytelling makes complex financial concepts easy to grasp and remember, while the practical advice empowers readers to take immediate action. By focusing on small, manageable changes, the book provides hope and a clear path forward for anyone looking to improve their financial situation.

While some may find the story format less direct than traditional finance books, the principles conveyed are solid and have the potential to create significant long-term impact. The key lies in consistently applying these principles and being patient as small changes compound over time.

Rating: 4.4/5

An engaging and empowering guide that demonstrates how small, daily financial decisions can pave the way to long-term wealth and financial freedom.

Alternative Books

If you enjoyed “The Latte Factor,” you might also find value in these related books on personal finance:

Rich Dad Poor Dad by Robert T. Kiyosaki

Challenges conventional wisdom about money and offers a new perspective on financial education.

Rating: 4.5/5

The Total Money Makeover by Dave Ramsey

Provides a step-by-step guide to getting out of debt and building wealth.

Rating: 4.7/5

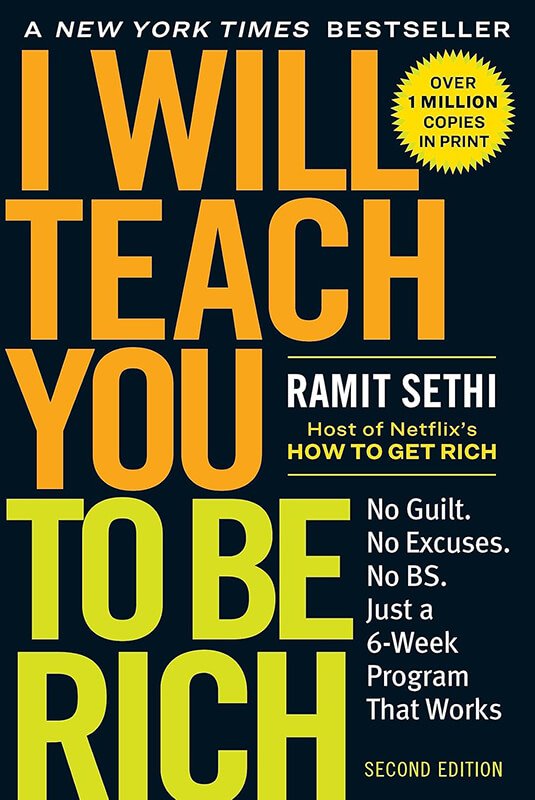

I Will Teach You to Be Rich by Ramit Sethi

Offers a practical approach to personal finance for young adults.

Rating: 4.5/5