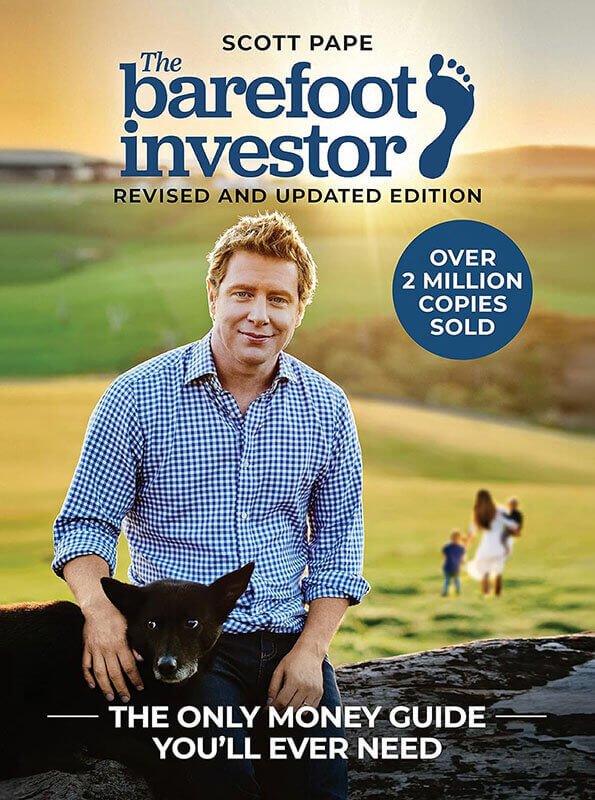

In a world filled with complex financial advice, Scott Pape’s “The Barefoot Investor: The Only Money Guide You’ll Ever Need” emerges as a beacon of clarity and practical wisdom. “The Barefoot Investor” is a groundbreaking personal finance book that has transformed how Australians and readers worldwide think about money management.

Published in 2016, this straightforward guide breaks down complex financial concepts into actionable steps, making financial freedom accessible to everyone, regardless of their starting point.

Core Concepts

Pape’s approach revolves around a simple, practical framework for financial success:

- Setting up basic banking infrastructure with specific account types

- Implementing the “Barefoot Steps” – a series of achievable financial milestones

- Following the “Bucket Strategy” for organizing and automating your money

- Creating sustainable wealth through long-term, low-cost investment strategies

These concepts work together to create what Pape calls your “financial fireplace” – a warm, secure place where your money works for you.

Chapter-by-Chapter Review

Foundation Steps

Introduces the fundamental banking setup and automated money management system. Pape’s “Bucket Strategy” divides income into three categories: daily expenses, splurging, and long-term wealth building. The chapter includes detailed instructions for setting up specific bank accounts and automating transfers, making implementation crystal clear for readers.

Step 1: Extinguish Your Credit Card Debt

Provides a practical, step-by-step approach to eliminating credit card debt using the “Debt Domino” strategy, emphasizing the importance of tackling high-interest debt first. Pape introduces his “Debt Destroyer” system, complete with negotiation scripts for reducing interest rates and accelerating debt repayment.

Step 2: Save a Safety Net

Details how to build an emergency fund, with specific strategies for saving and where to keep your money for optimal security and access. The chapter includes Pape’s innovative “Mojo Account” concept, designed to give readers both financial and emotional security during challenging times.

Step 3: Build Your Long-Term Wealth

Explains straightforward investment strategies focusing on low-cost index funds and superannuation optimization, making wealth building accessible to everyone. Pape provides detailed breakdowns of asset allocation strategies and introduces his “Tread Your Own Path” philosophy for personalized investment decisions.

Key Strengths

- Practical, actionable advice that can be implemented immediately

- Clear, jargon-free explanations of complex financial concepts

- Step-by-step implementation guides with specific product recommendations

- Focus on behavioral change and sustainable financial habits

Potential Drawbacks

- Some specific recommendations are Australia-focused

- Investment advice may be too conservative for aggressive investors

- Regular banking product recommendations may need adaptation for different countries

Who This Book Is For

“The Barefoot Investor” is perfect for:

- Financial beginners seeking a comprehensive money management system

- Those struggling with debt who need a clear path to financial freedom

- Young professionals wanting to build long-term wealth

- Anyone looking to automate their finances and reduce money stress

Final Review

“The Barefoot Investor” stands out for its practical, no-nonsense approach to personal finance. The book’s strength lies in its ability to make complex financial concepts accessible and actionable. While some aspects are Australia-specific, the core principles are universally applicable.

Rating: 4.6/5

This book is an invaluable resource for anyone seeking financial independence through proven, straightforward strategies. Its lasting impact on readers’ financial lives and the countless success stories from its community of followers are testament to its effectiveness as a financial blueprint.

Alternative Books

For readers interested in similar approaches to personal finance, consider:

“The Psychology of Money” by Morgan Housel

A thought-provoking exploration of how our behavior affects our financial decisions.

Rating: 4.7/5

“The Simple Path to Wealth” by JL Collins

Another straightforward guide focusing on index fund investing and financial independence.

Rating: 4.6/5

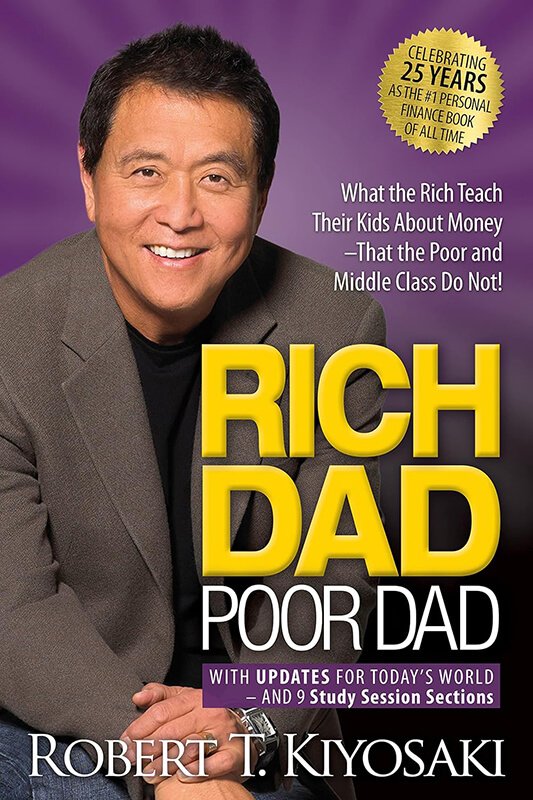

“Rich Dad Poor Dad” by Robert T. Kiyosaki

A different perspective on building wealth through financial education and asset acquisition.

Rating: 4.5/5