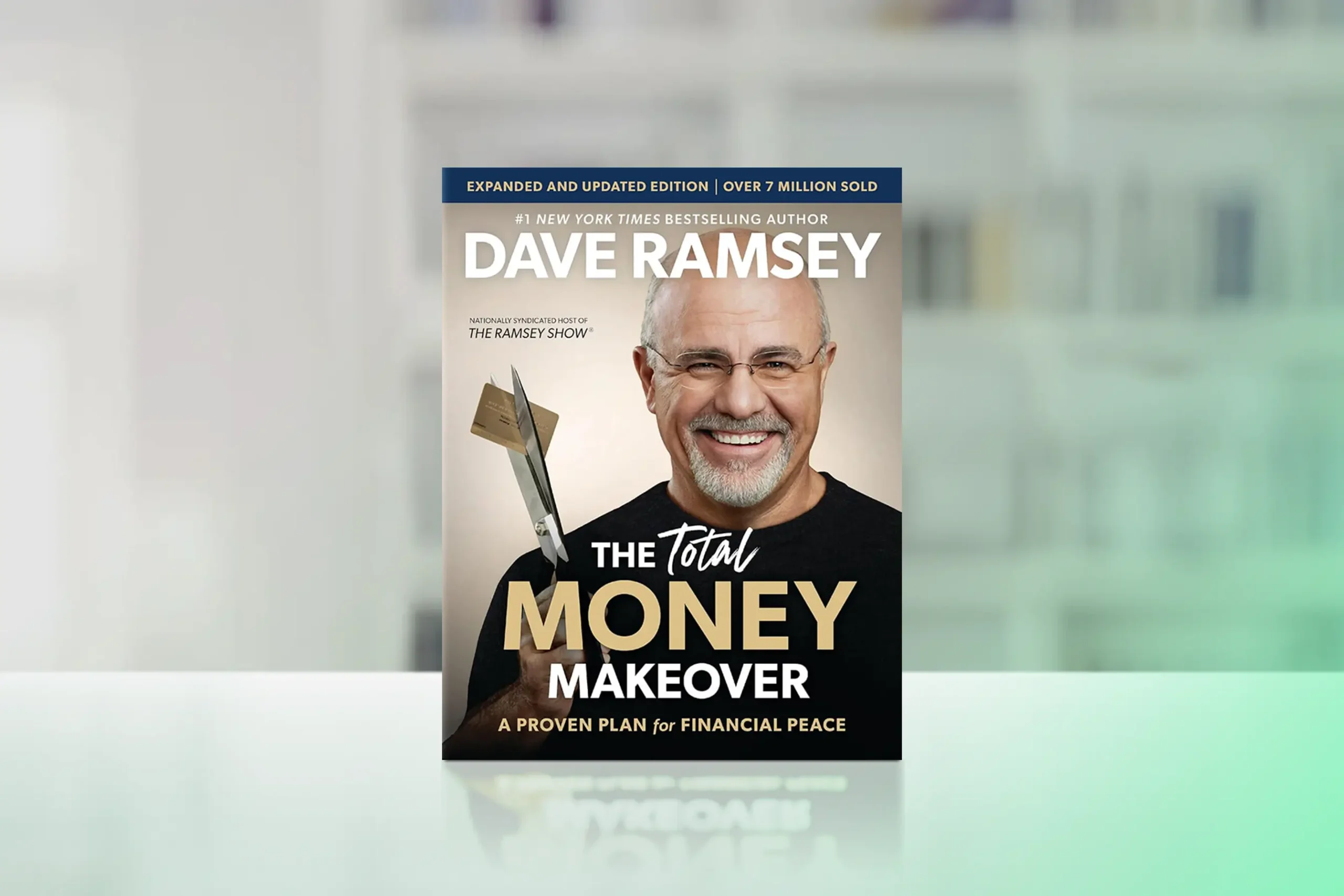

In “The Total Money Makeover: A Proven Plan for Financial Fitness,” financial guru Dave Ramsey presents a straightforward, no-excuses approach to getting your finances in order and building wealth.

First published in 2003 and regularly updated, this bestseller has helped millions of readers transform their financial lives. Ramsey’s book stands out in the personal finance genre for its clear, step-by-step plan and its emphasis on behavior change rather than complex financial strategies.

Whether you’re drowning in debt or simply looking to secure your financial future, this book offers a powerful roadmap to achieving true financial freedom.

Core Concepts

At the heart of “The Total Money Makeover” is Ramsey’s belief that financial success is 80% behavior and 20% knowledge. The book presents a series of “Baby Steps” designed to guide readers from financial distress to prosperity:

- Save $1,000 for a starter emergency fund

- Pay off all debt using the debt snowball method

- Save 3-6 months of expenses for a full emergency fund

- Invest 15% of income for retirement

- Save for children’s college education

- Pay off your home early

- Build wealth and give generously

These steps aim to help readers break the cycle of debt, build financial security, and create long-term wealth, all while developing healthier money habits.

Chapter-by-Chapter Review

Chapter 1: The Total Money Makeover Challenge

Ramsey introduces the concept of a financial makeover and challenges readers to take control of their money. He emphasizes the importance of changing one’s mindset about money and debt.

Chapter 2: Denial: I’m Not That Out of Shape

This chapter addresses common financial myths and the denial that often accompanies money problems. Ramsey encourages readers to face their financial reality head-on.

Chapter 3: Debt Myths: Debt Is (Not) a Tool

Ramsey debunks popular myths about debt, arguing that all debt is dangerous and unnecessary. He presents a compelling case for living debt-free.

Chapter 4: Money Myths: The (Non)Secrets of the Rich

This section tackles misconceptions about wealth-building, emphasizing that true financial success comes from disciplined saving and smart investing, not get-rich-quick schemes.

Chapter 5: Two More Hurdles: Ignorance and Keeping Up with the Joneses

Ramsey addresses two major obstacles to financial success: lack of financial education and the pressure to maintain appearances. He provides strategies for overcoming both.

Chapters 6-12: The Baby Steps

These chapters detail each of the seven Baby Steps, providing clear instructions, real-life examples, and motivation for completing each stage of the financial makeover.

Chapter 13: Live Like No One Else

The final chapter encourages readers to maintain their new financial habits and enjoy the freedom that comes with financial peace.

Key Strengths

- Clear, step-by-step plan that’s easy to follow and implement

- Motivational writing style that inspires action

- Emphasis on behavior change and developing healthy money habits

- Real-life success stories that demonstrate the plan’s effectiveness

Potential Drawbacks

- Some may find Ramsey’s approach to debt too extreme

- The investment advice is relatively basic and conservative

Who This Book Is For

“The Total Money Makeover” is an excellent resource for a wide range of readers, including:

- Individuals struggling with debt and looking for a clear path to financial freedom

- Young adults starting their financial journey and wanting to avoid common money pitfalls

- Couples seeking to align their financial goals and habits

- Anyone looking to improve their financial health and build long-term wealth

Final Review

“The Total Money Makeover” delivers a powerful, no-nonsense approach to achieving financial freedom. Dave Ramsey’s straightforward advice and step-by-step plan provide readers with a clear roadmap for transforming their financial lives. The book’s strength lies in its simplicity and its focus on changing financial behaviors, rather than just imparting knowledge.

While some readers may find Ramsey’s approach to debt aggressive, the potential for financial transformation is significant for those who commit to following the Baby Steps. The book’s emphasis on building emergency savings, eliminating debt, and consistent investing provides a solid foundation for long-term financial success. Whether you’re deep in debt or simply looking to secure your financial future, “The Total Money Makeover” offers practical, motivating guidance to help you take control of your finances and build lasting wealth.

Rating: 4.7/5

A game-changing guide that empowers you to take control of your finances and create a secure, prosperous future.

Alternative Books

Looking for alternatives, consider these related books for further insights on personal finance and wealth-building:

Rich Dad Poor Dad by Robert T. Kiyosaki

A thought-provoking look at how the wealthy think about money and investing.

Rating: 4.5/5

I Will Teach You to Be Rich by Ramit Sethi

A modern, actionable approach to personal finance for young adults.

Rating: 4.5/5

Your Money or Your Life by Vicki Robin and Joe Dominguez

A holistic view of money management that ties financial decisions to life satisfaction.

Rating: 4.5/5