In a world where financial literacy is crucial yet often overlooked, J.D. Roth’s “Your Money: The Missing Manual” emerges as an essential guide for anyone seeking to take control of their financial future.

This comprehensive manual breaks down complex financial concepts into actionable steps, making money management accessible to readers at any stage of their financial journey. Drawing from his experience as a successful financial blogger and his own journey from debt to financial independence, Roth delivers insights that bridge the gap between financial theory and real-world application.

Core Concepts

This book stands out by integrating three fundamental pillars of financial success:

- Mindset transformation and behavioral change

- Practical money management techniques

- Long-term wealth-building strategies

These concepts are woven together to create a holistic approach to personal finance that addresses both the psychological and practical aspects of money management.

Chapter-by-Chapter Review

Foundation Building

Roth begins by addressing the psychological aspects of money, helping readers understand their relationship with finances and how to develop healthy money habits. Through engaging exercises and self-reflection prompts, readers discover their money beliefs and learn how to reshape limiting financial mindsets into empowering ones.

Income Optimization

The book explores various ways to maximize earnings through career development, side hustles, and passive income streams, providing actionable strategies for increasing your financial base. Roth includes detailed case studies of individuals who successfully diversified their income sources, offering blueprints readers can adapt to their own situations.

Smart Spending

This section offers practical advice on budgeting, cutting costs, and making mindful purchasing decisions without feeling deprived. The author introduces innovative money-tracking systems and demonstrates how to create sustainable spending plans that align with your values and long-term goals.

Debt Management

Readers learn effective strategies for tackling debt, including prioritization methods and acceleration techniques for faster debt elimination. Roth provides step-by-step debt reduction plans and introduces powerful concepts like debt snowballing and avalanche methods, complete with calculators and worksheets to implement these strategies.

Key Strengths

- Clear, actionable advice that can be implemented immediately

- Balanced approach combining psychological and practical aspects

- Comprehensive coverage of essential financial topics

- Real-world examples and case studies that illustrate key concepts

Potential Drawbacks

- Some investment strategies may need updating for current market conditions

- Could provide more detailed information about newer financial technologies

- May feel overwhelming for absolute beginners due to comprehensive scope

Who This Book Is For

This book is particularly valuable for:

- Young professionals starting their financial journey

- Mid-career individuals looking to optimize their finances

- Anyone seeking to develop a more structured approach to money management

- People struggling with debt who need a clear path to financial freedom

Final Review

“Your Money: The Missing Manual” succeeds in providing a comprehensive framework for financial success. While some sections may need contemporary updates, the core principles remain invaluable. The book empowers readers with both the knowledge and tools needed to transform their financial lives.

Rating: 4.5/5

This book is an excellent investment in your financial education, offering practical strategies that can lead to lasting financial success. Its greatest strength lies in empowering readers to take immediate action, transforming complex financial concepts into achievable daily practices.

Alternative Books

For readers interested in expanding their financial knowledge, consider these highly-rated alternatives:

“The Psychology of Money” by Morgan Housel

A fresh perspective on how psychology affects our financial decisions.

Rating: 4.7/5

“The Barefoot Investor” by Scott Pape

A no-nonsense, step-by-step guide to managing your money and creating lasting wealth.

Rating: 4.7/5

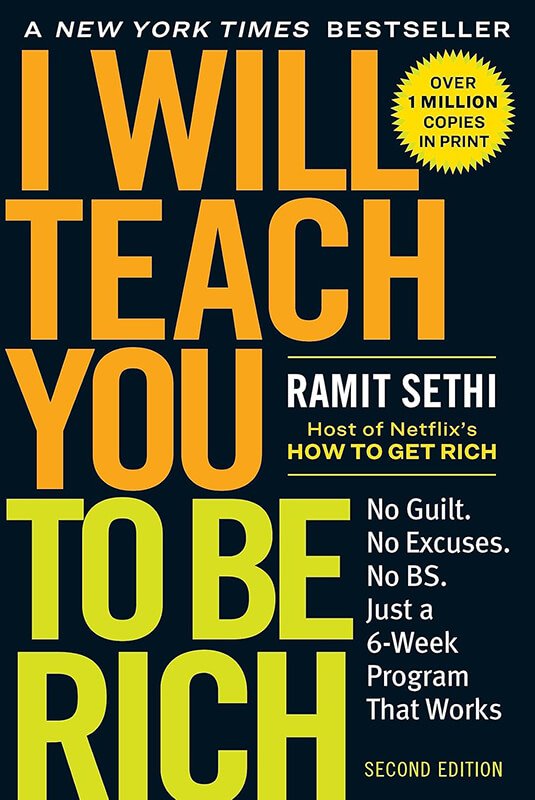

“I Will Teach You to Be Rich” by Ramit Sethi

Offers a modern approach to personal finance with emphasis on automation and psychology.

Rating: 4.5/5